The COVID-19 pandemic has ushered in an entirely new world, fundamentally changing the business world as we know it.

Consumers are now buying, living and thinking about their priorities differently.

Considering these global circumstances, the FMCG sector in India has fared decently this year, in part due to pent-up demand since June- July.

According to a joint report by FICCI and Deloitte, it is consumer data and technology disruptions that will drive retail and FMCG towards a growth-phase where the consumer experience (CX) will become the main focus for all brands.

1) Acceleration of e-commerce: With consumers preferring to stay indoors, many significant purchases are being made online. This has led to FMCG brands-

- Launching exclusive “digital only” products on online platforms or apps

- Partnering with food-delivery partners like Swiggy and Dunzo to deliver goods directly to customers

- Ensuring a more seamless and contact-less customer experience at the touch of a button

A recent example of exclusive new products being launched during this period is Dabur India. They launched several new products exclusively on the e-commerce space, like apple cider vinegar, 8 new ‘Dabur Baby Range’ products and Dabur cold-pressed mustard oil.

(Source: Amazon)

2) Increased rural demand: The pandemic had a devastating effect on almost 40 million migrant workers. But in the past few months, with the a) reverse migration of labour, b) a good monsoon and c) higher MNREGA spends, FMCG companies have noted a favorable uptick in rural demand.

In fact, Nielsen has reported that rural consumption growth in rural areas has reached 85% of Pre-COVID levels, outpacing that of urban. FMCG brands have therefore turned their attention to the hinterlands, adding a greater field force to continue to enhance direct distribution reach to the rural market.

(Source: Representational image)

3) Focus on health, nutrition and hygiene: An increased awareness about personal hygiene and social distancing has led to a jump in demand of products like hand-sanitizers, liquid hand soap and household cleaners.

In another Nielsen India report, they revealed that a total of 1,897 products specifically in the health and hygiene category have been launched. This translates to an 18% jump in 6 months, with more expected to follow.

Customers are also now increasingly looking for healthy and fresh food options. That’s why FMCG companies like Nourish Organics, iD Fresh Food and Zappfresh have witnessed a boost in online sales and enquiries. They deliver everything from fresh meat, breakfast cereals, preservative-free and Ready to Cook meals to organic produce and other sustainable food, directly to customers.

(Source: Amazon)

4) Renaissance of kirana stores: Lockdowns and convenience have caused consumers to gravitate towards their neighborhood grocery stores for essentials like food, beverages and household products.

Locally sourced products are being purchased from community stores. FMCG brands are therefore finding creative ways to leverage this local connection by customizing products for local needs and engaging in relevant ways with the locality.

Understandably, these kirana stores need a technological makeover. It’s encouraging to see investments from companies like SnapBizz and Jumbotail providing digitization solutions to these shop-owners.

(Source: Jumbotail)

Given these major anticipated trends in the retail sphere, how should FMCG companies like yours plan for the future? Here’s our three-step action plan we would like to propose:

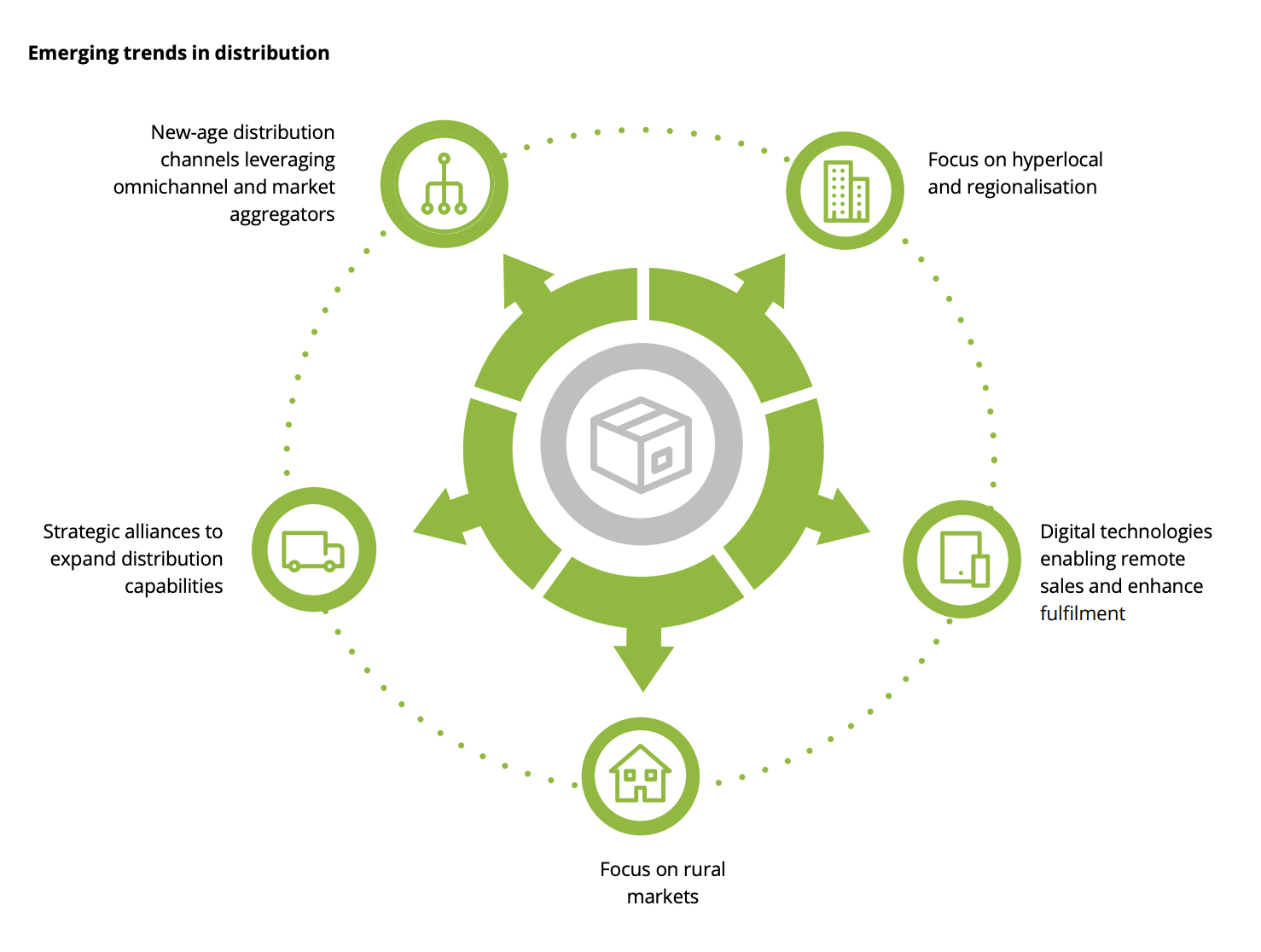

1) Distribution Model Overhaul

With the distributor channels shrinking because of the pandemic, there is a burning need for FMCG brands to scale. They also need to focus on:

- technology

- higher margins

- better trained sales force

Many FMCG brands will fare better by moving to larger distributors who have a multi-state or national footprint. Similar to what some developing countries have started, there should be more than one distributor covering the entire market.

This shift in the balance of power between brands and distributors will cause a strategic partnership between them.

(Source: FICCI & Deloitte Report)

2) Collaboration is Key

A move that entails giving up total ownership of the distribution model and partnering with multiple players for the best market coverage between urban and rural markets must be considered by FMCG companies. They should:

- Create a superior shopping experience by focusing their best efforts on marketing, branding and in-store merchandising.

- Drive coverage by partnering with delivery partners and rural distribution companies.

3) Launching E-Commerce Portal

By investing in setting up their own websites, FMCG brands like yours will ensure a higher chance of capturing your target customers, who might be hesitant to venture outdoors due to the pandemic. This direct-to-customer (D2C) business model also helps in achieving better engagement.

This investment will have multiple other benefits for you such as a) a higher ROI, b) tapping into remote markets, c) enhancing customer experience and d) improve branding.

.jpg)

Fast Forward

If we press the fast-forward button to the year 2030, experts predict the overall retail market in India to double to $1.5 trillion from today’s $700bn. Out of that, e-commerce could take up 15-20% of the pie, driven by a digital revolution and higher smartphone and internet usage.

There are plenty of exciting developments on the horizon. The consumer retail journey will be in for a total upheaval. By utilizing cutting-edge technology such as Internet of Things (IoT) and predictive analysis, businesses will someday be able to map all the data being generated by consumer behavior today.

But until that day comes, there remains a growing need for FMCG brands like yours to pivot and reboot the businesses models in view of this disruption and the changing consumer behaviour.

To summarize, FMCG businesses now need to start:

-realigning their business models

-enhancing consumer experience

-building resilient distribution

How we can help

The need to reach your target customers, no matter where they are, is the need of the hour. It is also easier now than ever. By advertising across our print and digital channels, your brand can reach our 56 million readers and 139 million digital users. For more information, visit our website here.